Zerodha offers you the chance to place an order online, but are you wondering what is MIS in Zerodha?

MIS stands for Margin Intraday Square Off, which implies that it is a product for intraday traders.

MIS trading gives you the opportunity to trade intraday across segments including equity, commodity, currency, futures, options, index, etc. Placing MIS trades with the broker gives you the opportunity to reap the benefit of leverage from Zerodha.

In short, MIS trade is where you can buy shares for a day by availing of a 20% broker’s margin. Since it comes with the day validity hence you need to square off the position before the trading session ends.

Let’s understand MIS meaning with an example.

What is MIS in Zerodha with Example?

MIS is the Margin Intraday Square-off where you can buy and sell orders for a day, i.e. if you buy shares in the morning then you need to sell them before the trading session ends.

Similarly, if you sell shares (short-selling) then you have to close your position before 3:20 PM.

It comes up with many benefits like the opportunity to earn a high profit, leverage benefits, placing multiple trades, etc.

To understand this, let’s take an example.

Let’s say Mr. Ramesh wanted to buy 20 shares of Reliance at ₹1200 each in the morning. Thus, he needed the total amount of ₹24000 to place the order but he had only ₹5000 in his trading account.

Here, he chose the MIS order from the buy window and gained the margin benefit of up to 5 times.

Let’s say he takes the margin of ₹20,000 from Zerodha and executed the buy order.

By 12 PM the price reached ₹1300 thus he thought of exiting the position by selling the shares and making the profit of ₹100 per share.

However, if the trader forgets to square off the position on time, then the broker executes the trade to get the margin back. This could lead to loss for traders and hence it is essential for traders to exit their position on time in MIS order.

Now let’s learn how one can place the MIS order in Zerodha.

How To Place MIS Order in Zerodha?

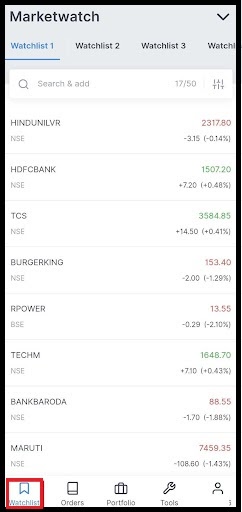

1. Open Zerodha Kite App and go to Watchlist.

2. Choose the Stock in which you want to place an MIS order.

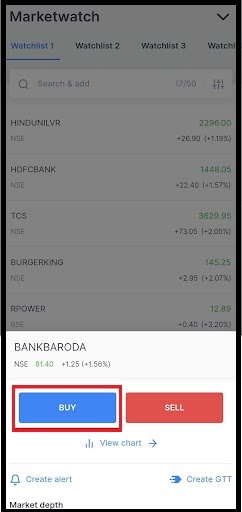

3. Tap on the Buy option.

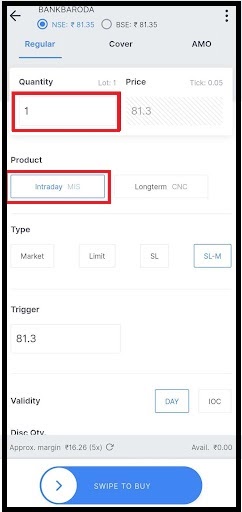

4. Now, enter the price, quantity and choose the option of MIS(Intraday).

5. Similarly, fill in the other options according to your preference.

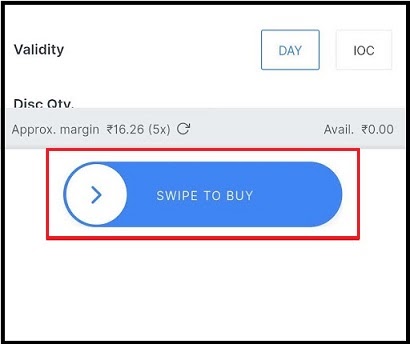

6. Swipe to Buy the required quantity.

7. On confirmation, the order is placed successfully.

How to Sell MIS Order in Zerodha?

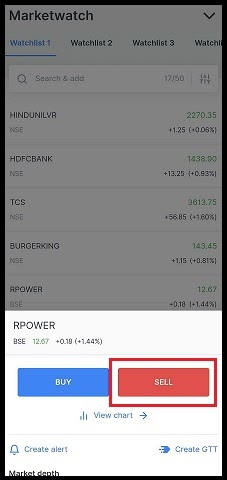

1. Open Zerodha Kite App and go to watchlist, choose the Stock you want to form the MIS product in the Zerodha app.

2. Choose the sell option to sell the stock.

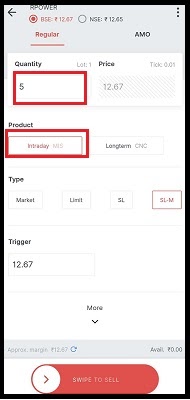

3. Now, enter the quantity and choose the option of MIS(Intraday). Fill in the other required fields.

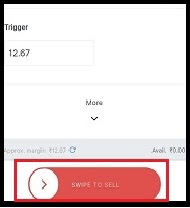

4. Swipe to Sell the required quantity.

Hope this information helps you in understanding what MIS order in Zerodha means. Further, in case of any query and doubt feel free to reach us!