There are very few stockbrokers in the Indian stockbroking space these days that levy demat account opening charges at all. Zerodha is one of those very few. In this quick review, let’s learn Is Zerodha Account Opening Free or there are a few charges involved.

With Zerodha, you can open different kinds of demat accounts, including:

- Demat Account

- Commodity Account

- NRI Demat Account

- Minor Demat Account

- Offline 3 in 1 Demat Account

- Zerodha 3 in 1 Demat Account

The charges, if any, obviously vary on the type of demat account you open.

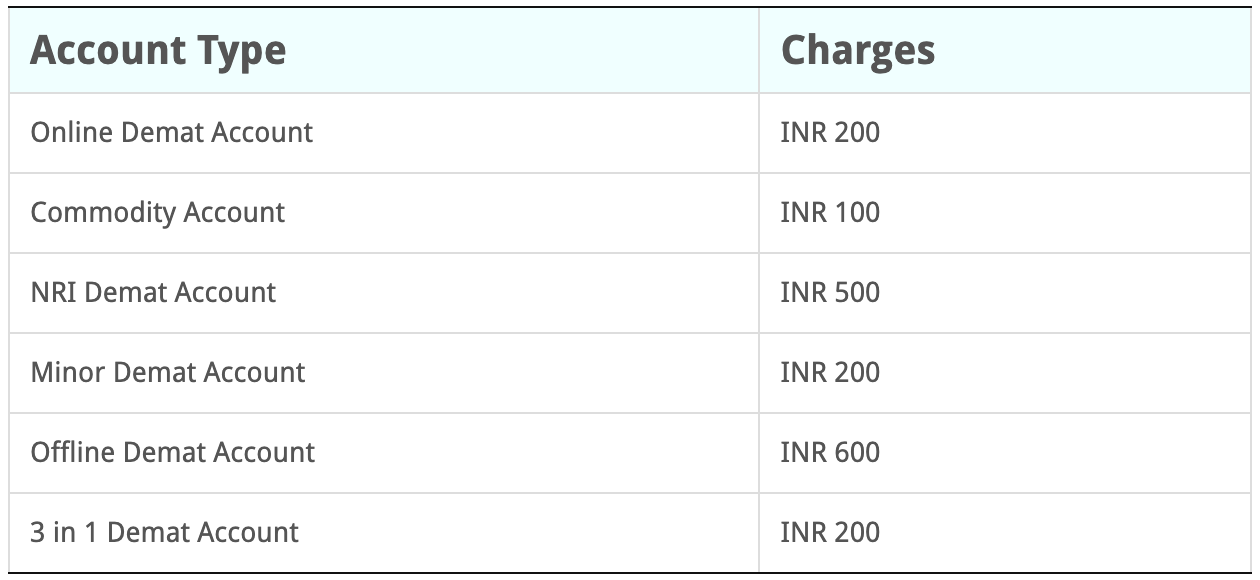

Zerodha Demat Account Opening Charges

Here is a quick view of the different Zerodha Demat account opening charges that you must be aware of:

The account opening charges are to be paid while you are in the Zerodha Demat Account Opening process itself. These payments can be made via:

- UPI

- Credit Card

- Debit Card

- Netbanking

- Wallet

- Cheque (if you are opening your demat account offline)

Some of the points that you need to consider while paying the Zerodha Demat account opening charges:

- You cannot open a commodity demat account without opening a demat account for equity investments

- The offline process requires paperwork and that is why the account opening charges for the offline format are higher

- While paying through the cheque, it needs to be addressed to Zerodha Broking Ltd

- If you are looking to open a 3-in-1 Demat Account, Zerodha offers that through the IDFC bank as well. The charges are the same as a normal demat account in Zerodha

If you would like to know more about the charges in the stock market, feel free to put your details in the form below and we will call you back for further information: